Despite issues with labor, inflation, and regulatory matters, electroplaters and anodizers believe 2023 will be a fruitful year for them again.

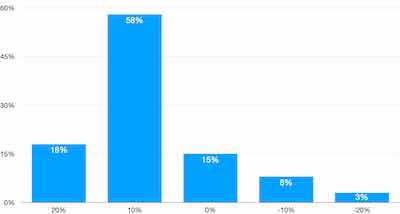

Sales in 2022 vs. 2021 sales.In a survey conducted by www.FinishingAndCoating.com in January, more than 75% of shop owners say they expect to see a 10% to 20% increase in sales in 2023 over 2022.

Sales in 2022 vs. 2021 sales.In a survey conducted by www.FinishingAndCoating.com in January, more than 75% of shop owners say they expect to see a 10% to 20% increase in sales in 2023 over 2022.

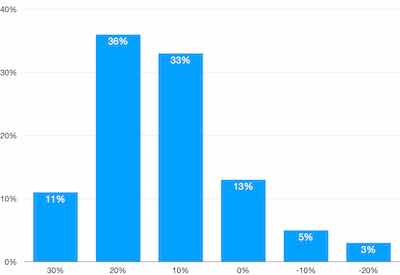

And even though 2022 was a tough year for hiring and retainers workers — as well as rising inflation and increased supply costs — almost 80% of shop owners say they saw at least a 10% increase in sales from 2021, when the U.S. was beginning to recover from pandemic effects.

About 34% of shop owners say last year saw a 10% rise in sales in 2022 from 2021, and 36% say they had a 20% increase; almost 11% reported sales increased over 30% last year from the year before.

“We have heard from a key customer that their volume will decrease by 25%,” says one shop owner. “However, we continue to gain new customers almost weekly, so our hope is that we can still increase our sales by about 10% over last year since 2022 was a tough year.”

Projected sales in 2023 vs. 2022.Some shop owners, meanwhile, say they are still skeptical about 2023 being a better year than 2022.

Projected sales in 2023 vs. 2022.Some shop owners, meanwhile, say they are still skeptical about 2023 being a better year than 2022.

“Higher interest and fuel prices are impacting my customers,” one owner said. “We are seeing 25% decreases across the board, which should start easing the second quarter of 2023.”

Some owners had a similar skepticism:

- “I am highly concerned about pricing strategy as it seems my costs go up for paint and other supplies 10% every three months. Keeping my prices competitive is very hard with inflation.”

- “Already seen a reduction in the last quarter of 2022.”

- “There should be a steady growth in the aerospace and defense sectors.”

Projected capital expenditure purchases in 2023.“In the last quarter of 2022, we saw our sales contract about 15%. I expect the first quarter to be down about another 10% and hope that sales will begin to start rebounding in the second half.”

Projected capital expenditure purchases in 2023.“In the last quarter of 2022, we saw our sales contract about 15%. I expect the first quarter to be down about another 10% and hope that sales will begin to start rebounding in the second half.”- “I believe a mild recession will continue through 2023 into very early 2024. We hope to stay similar to 2022 by increasing market share.”

- “I see a (hopefully slight) to moderate recession in 2023. Commodity and chemical prices have just gone sky high the last 18 months.”

- “Only a slight gain in actual sales, but there will be a bigger gain due to higher metal prices.”

- “We have 100% room for growth on a swing shift and plan on taking advantage of that.”

- “We have a lot of work that is supposed to be coming, but we have very few contracts, so it will depend on how the economy.”

Still, 2022 was a lot better than most owners anticipated, and they were happy to collect the gains that came after a tough 2021.

Biggest concerns for 2023.“We had a series of electrical outages that damaged our systems and impacted operations. This caused our sales to drop and become equal to the previous year.”

Biggest concerns for 2023.“We had a series of electrical outages that damaged our systems and impacted operations. This caused our sales to drop and become equal to the previous year.”- “Customers reported some constraints in part volumes due to supply chain issues. If issues are resolved in 2023, they expect to send a significant increase in parts for processing.”

- “We increased sales and margins but have not gotten back to 2018 numbers yet.”

- “It was a crazy year, and we didn’t get caught up until 4Q. It was our best year ever in sales and will be hard to match in 2023.”

- “Tough year; higher costs and lower demand.”

- “Actual increase 19%; very grateful.”

- “First 3 quarters were solid, and the last was a big drop off across the board.”

- “The 2Q and 3Q were much better than we anticipated. The 4Q contraction was disappointing.”

- “I feel this is due more to having to raise prices to cover rising costs more than making more money.”

- “Many of the gains in sales came from failing plating shops whose customers we’re looking for stability.”

- “Good sales, but we had to work for every dollar. We had to watch the cost and raise prices as needed to keep margins. So we are busy trying to get work out; it’s hard to pay attention to the income statements.”

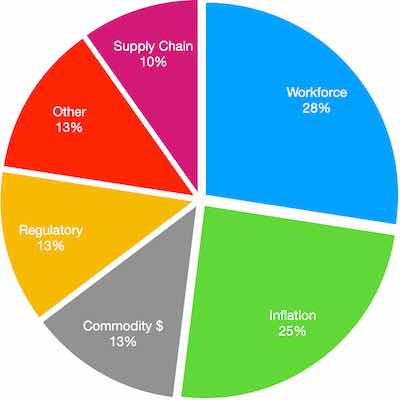

Workforce issues and a lack of labor were the big worries for most shops, as 28% reported that was their No. 1 concern for 2023. Inflation (25%) was second, followed by rising commodity prices (13%), and regulatory issues (12%) were not far behind.

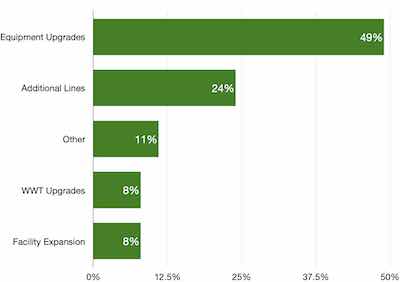

Despite the uncertainty of the economy, almost 90% of shops say they plan to spend capital in 2023. Almost 49% say they plan to upgrade their equipment, and 24% say they will spend to install new finishing lines. About 57% say their capital budget is between $100,000 and $500,000, with 13% reporting they are planning to spend at least $1 million in capital purchases.

More than 260 shops took part in the survey, which was open for one full week, the second week of January.